Key fundamentals of UK student property market

What are the key fundamentals of the student property market in the UK?

What should investors consider when choosing to invest in student property?

Since the Conservatives lifted the cap on university admissions, the fundamentals of UK student property market are looking good in 2020 as the students number have swollen. However, not all institutions have benefitted equally. Whilst Russell Group universities have generally seen their numbers swell, newer universities and former polytechnics have struggled. What should investors be aware of when choosing a student property?

- What should investors consider when choosing to invest in student property?

- Elite institutions faring better

- Student property development potential

- Demand for student accommodation and competing developments

- International students and their need for student accommodation

Elite institutions faring better

The intake of students to Russell Group institutions has grown by 16%. Some elite institutions such as Oxford and Cambridge have chosen not to expand, but many have, using the extra tuition fees to fund research. Bristol’s intake shot up 62%, Exeter’s by 61% and Newcastle’s by 43%. On the other end of the scale, the University of South Wales saw its admissions shrink by around 40%, and London Metropolitan by over 40%.

Download our free student guide!

Students are also expressing a preference for campus-based universities as opposed to universities with sites sprawled across the city centre. With the rise of those aged between 16-24 reporting as being teetotal reaching almost 30%, students are placing less of an emphasis on being close to clubs and pubs and more on being close to their university.

Student property development potential

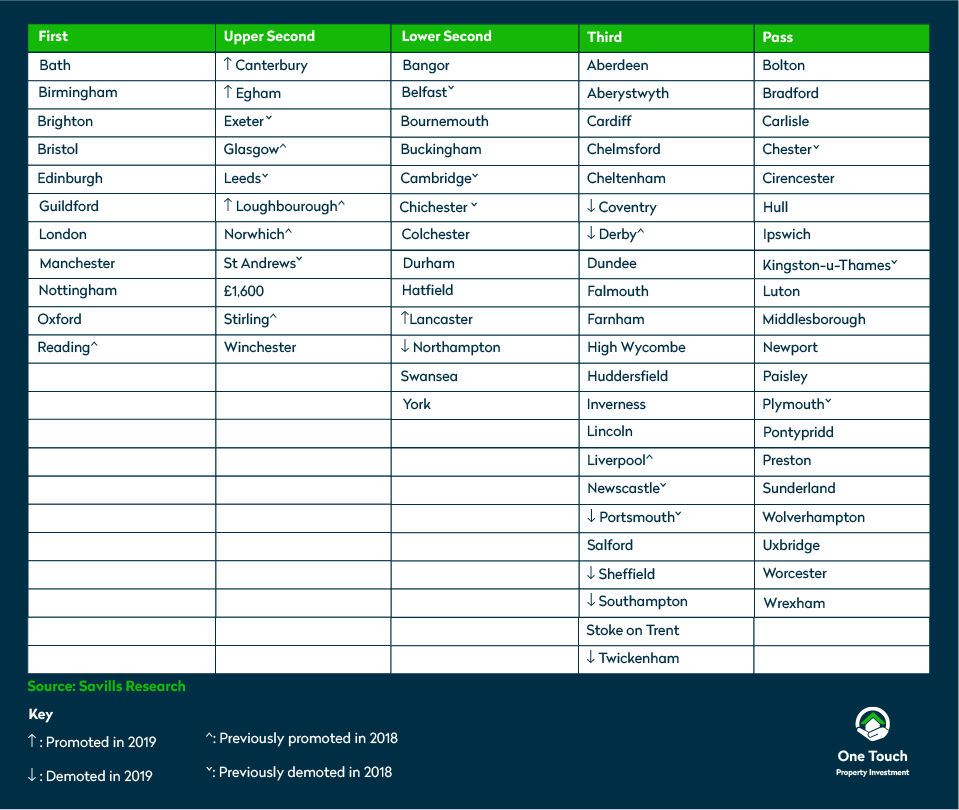

Looking at research from Savills which measures the potential of student property developments in the UK’s university towns and cities, it is of no surprise to see the universities with increased intake ranking in the first or upper second tier. These demonstrate the most potential due to supply and demand imbalances and yields that can be achieved. Generally, the influx of students has not been matched by an increase in beds, increasing demand for existing stock.

Universities such as Bristol, Manchester, Birmingham and Nottingham rank well across all league tables. That’s not to say a good university ranking translates directly into a good investment. Many other factors are at play such as the availability of accommodation and its quality, prices, planning restrictions and projected future admissions.

Demand for student accommodation and competing developments

Having a consistent demand is key to achieving good occupancy levels and rental yields. Investors should look at towns and cities with strong performing universities where admissions are increasing year-on-year.

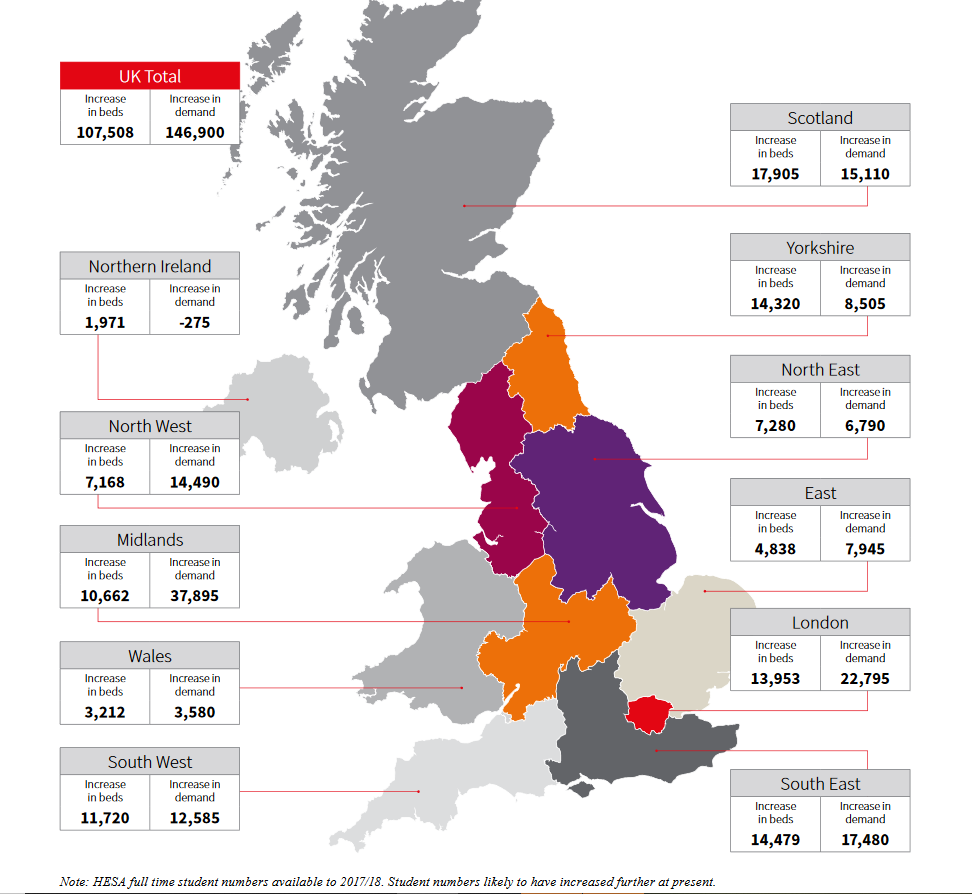

It’s not just about student numbers though. If student numbers are increasing but there are enough developments to accommodate them, your property will face tough competition from others as students will have more choice. If you have set your sights on a particular city, your next step would be to examine other student developments in the area. Although almost all areas in the UK are seeing an increase in demand to one degree or another, the demand hasn’t risen equally and in some cases the number of beds being built has outstripped demand.

Source: JLL Student Housing Report

The midlands has one of the most drastic contrasts between increase in demand and increase in beds, with demand increasing by 37,895 vs a 10,662 increase in beds. This is likely why places such as Loughborough and Nottingham fare so well on the Savills Student Development League Table as they are home to prestigious universities with fewer student beds compared with demand.

You should also consider the potential number of students who will apply to study in a city. This is not only dependent on the rankings of the universities in the city or how many universities are based there, but also how far people are willing to travel to attend it and the pool of potential candidates. Most domestic students only really move a short distance away to study. Universities such as Durham and Exeter recruit around 70% of their students from over 100 miles away and this means that a) they will have a more pressing need for accommodation and b) there is a larger pool of potential candidates applying.

International students and their need for student accommodation

When assessing the need, also consider the proportion of international students. Unlike many domestic students who live close to their university, it would be physically impossible for them to commute for lectures. There is usually a correlation between how well universities rank and the percentage of international students enrolled as these universities enjoy worldwide acclaim.

The universities with the highest proportion of international students are as follows:

University College London: 12,742

The University of Manchester: 10,880

The University of Edinburgh: 8,138

Coventry University: 7,658

The University of Sheffield: 7,486

King’s College London: 7,054

The University of Liverpool: 6,919

University of the Arts, London: 6,689

The University of Leeds: 6,566

The University of Birmingham: 6,498

The importance of international students and occupancy levels cannot be underplayed when it comes to choosing a student investment property. Around 94% of international students rent, compared to 70% of UK-based students. This equates to around 250,000 international students renting across the UK each year. 79% of international students that rent do so in the PBSA sector, and they are much more likely to remain in the same accommodation for a number of years, providing steady yields for investors. International students are much more willing than UK-domiciled students to pay for premium features such as 24-hour security, onsite gyms and cinema rooms.

The percentage of international students could also influence what sort of student accommodation you choose to invest in. For example, you might choose a more premium student property investment in Sheffield S1 to accommodate the high number of international students in the city who would gravitate towards a property with modern features. HMOs are not as appealing to international students and therefore might not do so well in a city that attracts a lot of people from overseas. The addition of a gym and communal areas makes it more attractive to students, both domestic and international.

In conclusion, there are many fundamentals you would have to consider before choosing to invest in student property. Not only would you have to study the current supply and demand, you will also have to research upcoming student developments, how many will need to be refurbished and therefore taken out of service, and the ability of the universities in the area to attract new students. You’d then have to analyse the student demographic and match them with a preferred student accommodation type.

Choosing to invest in student property means a lot of research and we understand it can be quite overwhelming, especially to someone who has not invested before. Whilst real estate providers such as Savills and JLL release research papers weighing up each city’s investment potential, it can take a long time to effectively go through all the data and pick an investment that works for you.

To find out more, we recommend you

download our free student guide!

Here at One Touch Property we offer student accommodation investments that have been scrutinised by our in-house investment analyst. We also offer other UK property investment opportunities or you could simply keep up to date with property news UK and get in touch when the time is right.

Start your property journey...

Recommended Properties

Related Articles

Are you curious?

Speak with an experienced consultant who will help identify suitable properties that will capture the exciting fundamental mentioned here.

WANT TO LEARN MORE ABOUT PROPERTY INVESTMENT?

SIGN UP TO OUR NEWSLETTER NOW!