UK Property Market Terminology Explained

Explanation of property investment acronyms and terminology

Property Investment Glossary

If you are taking that first step into property investment, you may not be familiar with the terminology used. Whilst many terms are used in regular house buying, some terms and abbreviations can be completely new that first time investors may be unfamiliar with. To allow you to feel more comfortable reading through investment documents and brochures, we have broken down some of the most common property investment terminologies, and what they mean.

Related Articles

Start your property journey...

Below Market Value

Properties offered below the prices of what comparable properties in the area have sold at.

Buy to let investments

This is where you would buy a residential property and let it out, usually to professionals. Rental yields are usually lower to what can be achieved through a commercial property, but there is more scope for capital growth. Unless a management company is in place, you would be responsible for maintenance of the property including repairs and tenancies.

Capital Growth

The amount a property increases in value. Some properties have the potential to achieve more capital growth than others. Influencing factors can be the scale of regeneration in the area, improving transport links and job opportunities, and overflow from people priced out of surrounding areas.

Care Home investments

Invest in a room in a care home. A care home operator typically takes a 25-year lease with the care home investor. The company essentially runs their business from the premises leased from the owner. All day-to-day running of a whole care home business is completely taken care of and you would receive a guaranteed rental yield under a commercial contract. These are hands-off investments and demand is underpinned by Britain’s ageing population. These are usually cash only investments.

Recommended Properties

Start your property journey...

Commercial Property Investment

Commercial property generally refers to property that is used for business purposes. However, the term also extends to larger residential developments, such as student, care homes and hotels. There are five categories of commercial property and they are: offices, retail units, industrial, leisure and healthcare.

Council Tax

Local taxation in England, Scotland, and Wales on domestic property. In general, the occupier is responsible for payment of council tax, unless the property is an HMO in which case the landlord is responsible. Students are exempt from council tax and it is not applicable to care homes which means higher returns can be achieved.

Crowdfunding

Funding from a large group of people which is usually done online. For example, 100 or so people could club together to buy a property and receive a share of the rental yields and capital growth.

Diversification

The art of investing in a variety of assets to minimise exposure to market volatility.

Freehold

Owning the property and the land it sits on.

Gross Rental Yield

The amount of money a landlord or investor makes on a property before costs relating to the property (.e.g mortgage) have been deducted. Usually presented in a percentage figure.

Ground Rent

An annual charge the leaseholder pays to the freeholder for the ground the property sits on.

High Net Worth Investor

In the UK, a high net worth investor is defined as someone who has an annual income of £100,000 or more or has net assets to the value of £250,000 or more.

HMO

House in multiple occupation. A property that is rented out to three or more people who are not family and are not part of one household but share the house’s facilities such as the kitchen and bathroom. It is otherwise known as “house share” or “flat share”.

HMO Licence

If a landlord wants to rent a property as an HMO in England or Wales, they would need to check whether they need an HMO Licence. This is a must if the house is occupied by five or more people and at least one tenant pays rent.

A licence is valid for a maximum of five years and costs £1,100. The purpose of the licence is to ensure the house is fit for purpose. The council requires landlords to submit electrical safety certificates and gas safety certificates and install fire alarms in the property. Of course, it is an extra cost and we have found many people have started to move away from buy to let and consider other property investments that are not subject to the same licensing.

HMRC

Her Majesty's Revenue and Customs is a government department tasked with collecting taxes and other payments such as National Insurance.

Hotel room investments

These are categorised under commercial property investments. Investors would usually purchase a hotel room which is then leased back to the management company under a commercial contract. Investors would usually receive fixed yields for a defined period. There would be various clauses in the contract that would allow the company to buy back the hotel room from the investor at an increased price. This is usually after five years +. Hotel room investments are usually hands-off and sometimes a complimentary two-week stay per year is offered.

Leasehold

Leasehold is the customary form of ownership used for apartments. The freeholder grants a lease typically between 125 and 250 years to the leaseholder. The land itself belongs to the freeholder. The Leaseholder owns the apartment. The freeholder cannot withhold granting a lease extension. There is standard calculation of the lease extension which a chartered surveyor will provide according to the Government set parameters. Generally the freeholder would be responsible for maintaining the building.

Loan to Value Ratio - LTV

The ratio of a loan to the value of the property. For example, if your property costs £100,000 and you take out an £80,000 loan on it, that would be an 80% loan to value.

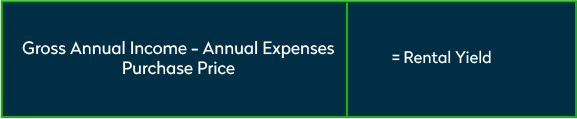

Net Rental Yield

The net rental yield is the amount of money an investor makes on the property through rent once all the payments in relation to the property (e.g. mortgage) have been deducted. It is presented as a percentage figure, calculated by taking the yearly rental income of a property and dividing it by the property price. Investors should compare rental yields achieved from similar properties in the area to understand the potential. The formula is as follows:

NRL1

A form to be completed by a non-resident landlord. If a landlord usually resides outside of the UK they can complete an NRL1 form to ensure the income they make in the UK is not taxed in the UK. The income may be subject to tax in the landlord’s home country.

Off Plan

To buy off-plan means to purchase a property prior to its completion. Investment property that is off plan tends to have payment plans in place where investors can pay in installments. This may make investment more manageable for someone who does not have the full capital at the present time.

PBSA

Purpose-built student accommodation. Housing built for students by private developers. Generally, these are either collections of self-contained studios with shared living spaces, or traditional halls of residence with en-suite bedrooms and shared kitchens.

Start your property journey...

Personal Allowance

The amount you can earn in the UK that you do not have to pay day on. It can change from year-to-year, but in the 2020/21 tax year it is £12,500.

Portfolio

If an investor owns several properties, it is referred to as a portfolio.

Purchase Process

The process of purchasing a property. With an investment property this would usually involve, choosing a property within a specific sector, paying a reservation deposit, instructing solicitors, exchanging contracts, stage payments until completion and then upon completion finding a tenant and collecting rent.

Instructing a solicitor to undertake the conveyancing process usually costs between £900+Vat - £1250+Vat

Return on investment

A return on investment is defined as the ratio of profit divided by the total cost of the investment.

Service Charge

A charge imposed on the leaseholder by the freeholder to maintain the property and carry out basic repairs. This may include heating and lighting in communal areas, upkeep of communal gardens and lift maintenance.

Stamp Duty

Stamp duty is paid in the UK if someone buys a house, flat, land or buildings over a set price. It is not applicable to first time buyers whose purchase is under £300,000. Stamp duty is 5% for first time buyers whose home is priced between £300,001 to £500,000.

Property or lease premium or transfer value SDLT rate Up to £125,000 Zero The next £125,000 (the portion from £125,001 to £250,000) 2% The next £675,000 (the portion from £250,001 to £925,000) 5% The next £575,000 (the portion from £925,001 to £1.5 million) 10% The remaining amount (the portion above £1.5 million) 12%

If you already own a property and you are buying another one, you will have to pay an additional 3% on top of the standard stamp duty rate.

Student property investments

These are often in the form of student HMOs or purpose-built student accommodation. Student HMOs are residential properties that have been repurposed to accommodate students. Each student will have their own bedroom but will share other facilities such as a kitchen or bathroom with other students. There are some benefits to owning this type of property. If an investor chooses to sell, it can be sold on to a residential buyer who wishes to make it their own home or a buy to let. This means there is more scope for capital growth as there is a larger market to sell to.

If an investor chooses to buy a student HMO, they will be expected to maintain it. This means that they would have to organise new tenancies and undertake any repairs. If they choose to buy a cheaper property to maximise rental yields, they would have to be mindful of how much they’d need to spend to bring it up to standard.

Purpose-built student accommodation is developed especially for students. It’s often newer with more high-spec facilities. The development is maintained by a management company, so investors do not have to worry about sorting out repairs or new tenancies. They also would not have to account for gaps in occupancy as this is absorbed by the management company. Investors would have to pay a yearly fee to the management company though, and units cannot be repurposed for residential use, so the market is more limited.

Armed with an understanding of these terms, you will be better equipped to explore different property investments. If you want to invest in buy to let, we recommend reading our best places to invest guide, if you want to invest in student property, why not read our checklist to successfully invest in student property.

Recommended Properties

Related Articles

Are you curious?

Speak with an experienced consultant who will help identify suitable properties that will capture the exciting fundamental mentioned here.

WANT TO LEARN MORE ABOUT PROPERTY INVESTMENT?

SIGN UP TO OUR NEWSLETTER NOW!