Is shared housing a popular option?

Shared housing in the UK – the new norm?

What are HMOs?

HMOs (or houses in multiple occupation) are properties which are shared by at least three tenants who are not from a single household or members of the same family. HMOs are otherwise known as shared housing and are commonplace in cities such as London due to high property prices.

Multiple occupation HMOs are becoming more popular in other towns and cities as people begin to recognise the social benefits they bring. Tenants can move into a property that is already furnished and liveable. It's often a short term solution and people living in shared accommodation do so until they can buy a home of their own.

Bills are usually included which means that they do not have the hassle of conducting meter readings, delegating certain bills, or dividing up living costs between one another. HMOs are ideal for those earning a lower wage or those who want to minimise their expenses.

The popularity of HMOs

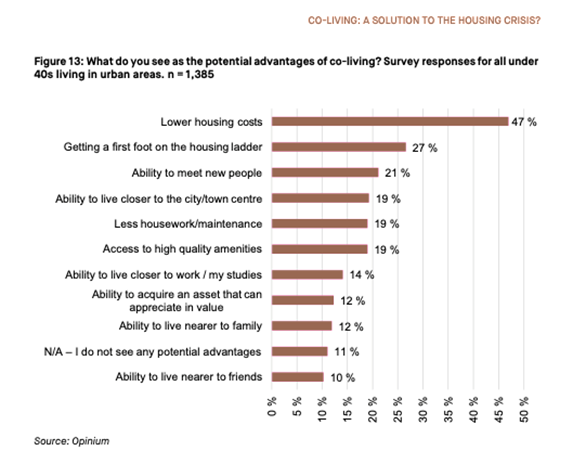

In a recent housing market report commissioned by Barclays 47% of respondents said that biggest potential advantage of co-living to reduce their housing costs.

Even though the tenants are reducing living costs, HMOs are also popular with investors as the higher number of tenants usually correlates with higher yields.

It is also worth noting that tenants are usually on separate contracts, so if one tenant decides to give notice landlords will still be receiving income from the others. Whereas if a landlord is letting a property to one family or household, if they decide to move the landlord is more at risk of a void period if they cannot immediately find a replacement. The preferred lettings management company renews the tenancies every six months, so there is a reduced vacancy rate as the landlord is always made aware of changing circumstances.

One aspect that usually puts off potential investors is the amount of work involved. An HMO is generally a more “hands-on” investment compared to a regular buy-to-let. Landlords are generally responsible for repairs, arranging HMO licensing, and negotiating tenancy agreements. However, there are still opportunities where that aspect is managed for the investor.

Doncaster's Job Growth

Under the Doncaster Inclusive Growth Strategy, plans have been laid out to create 13,000 jobs over the next fifteen years based on a “business as usual” growth rate. However, the aim is to create double that at 26,000 by implementing all actions in their strategy. That is not the only driver of new jobs in the area though as Doncaster’s convenient location has made it a key logistical area.

One consequence of the Coronavirus pandemic is that more and more people are switching to online shopping. When non-essential shops were closed shopping online was a necessity, but it seems as though more and more people are recognising the convenience, especially as the high street’s demise means that other options are limited.

According to a report conducted by Alvarez & Marsal and Retail Economics around 25% of the UK’s total population plans on making permanent changes to the way that they shop. The most dramatic finding was that those in older age groups who have been typically slower at adopting new technology such as online banking and shopping, but who have been forced to due to the virus, are the most likely to change their habits.

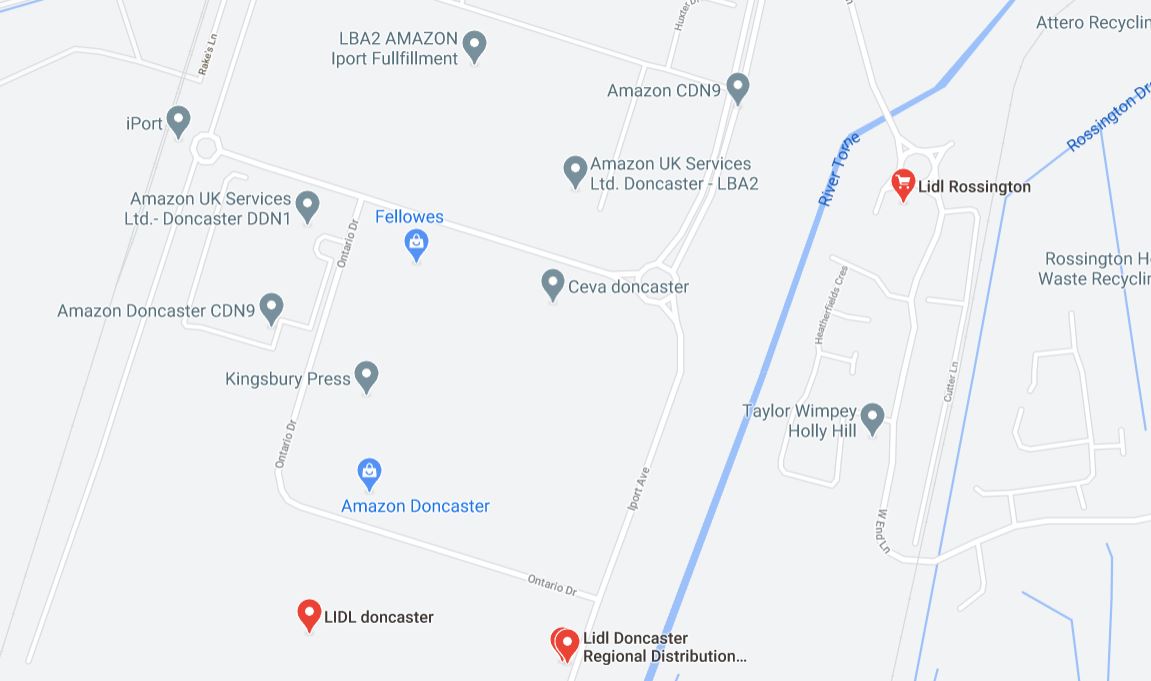

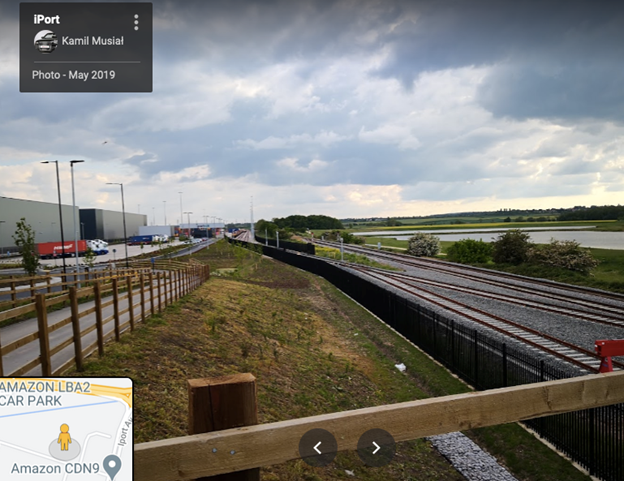

The surge in online shopping means that there is an increased need for warehouse space and warehouse workers, and plans are already in motion to deliver extra capacity. Just recently, it was announced that Amazon built an 800,000 sq. ft distribution centre in Doncaster, creating up to 1,000 jobs. See the new Doncaster distribution hub.

Doncaster as a transport hub

Most distribution centres are scattered around the A1 in the middle of the UK, making places such as Doncaster an ideal location for distribution centres as these routes allow drivers to quickly make their way up and down the country to dispatch goods.

It is not only the road connections which make Doncaster an attractive transportation hub. Many people may not be aware that Doncaster has an airport and is the base for the private commercial rail network used for distribution known as Iport private transport rail network.

Iport have their own direct high-speed rail links to HS1, delivering goods all over the UK very quickly. Services such as same day Amazon Prime delivery service take full advantage, plus direct quick access to M1 motorway. See the video explanation: https://youtu.be/2e-hQ_CEeuU

Property investment in Doncaster to house Amazon warehouse staff

Property investment in Doncaster and surrounding towns has been popular with investors, as they cater to warehouse workers needing inexpensive housing close to their place of work. The growing jobs market also provides a more buoyant demand and returns can be lucrative if the correct property in the correct location is chosen. For the foreseeable future, we believe there will be sustained demand due to growing employment options in the region.

Download our free buy-to-let guide today to learn more about the shared housing sector.

Of course, these workers will need somewhere to live. The bulk of the warehouse and distribution company jobs pay an average wage of £1600 per month. The jobs generally attract to a younger employee. For several people, it may be the first time they have lived out their family home. There is an instant appeal, for those for time tenants, to want to rent a property which comes fully furnished. With affordability of rent being a key factor when deciding which rental property to select.

One opportunity is an HMO investment in Doncaster. The property will undergo renovation which takes approximately eight weeks and includes re-wiring the property and ensuring it meets HMO guidelines.

A conservatory will be built which will be used as a living area, and existing living spaces will be converted into bedrooms. At the end of the renovation period, the house will present as a five-bedroom HMO. The developer has 25 years’ experience in the industry and investors have the option to view their operational properties before moving ahead with an investment.

The investment overall is £215,993 which includes the property, HMO licence and renovation costs. Upon completion, the investment will be advertised through spareroom.co.uk, and is usually tenanted within two weeks according to past performance of similar properties.

Ongoing management will be provided in terms of tenanting and maintaining the property, so investors can enjoy the income an HMO generates without the hassle. The average yield achieved is between 10% - 16.46% depending on initial leverage. Investors can also achieve a 15% return on cash invested.

The property itself is close to shops and other amenities and benefits from excellent commuter links. It is also close to Amazon’s warehouses and Lidl’s HQ, making it an ideal home for warehouse workers or those working in Doncaster.

The rising popularity of online shopping has providing the foundations for a buoyant property market near distribution hubs. Investors will have access to a workforce who require accommodation in the area, and a thriving employment market will allow for steady occupancy levels.

This will in turn help investors achieve good rental yields. If you're interested to learn more about the tax implications of investing in HMO property, next read our buy to let tax guide or contact us to discover more property investment opportunities in UK.

Start your property journey...

Nearby Leeds is one of the UK's fastest-growing cities and is experiencing a boom in its employment market. If you're looking for other property options, read about how Leeds should be worthy of investor consideration?

Recommended Properties

Are you curious?

Speak with an experienced consultant who will help identify suitable properties that will capture the exciting fundamental mentioned here.

WANT TO LEARN MORE ABOUT PROPERTY INVESTMENT?

SIGN UP TO OUR NEWSLETTER NOW!