UK Buy to Let Market Fundamentals

The basics of the UK buy to let market

UK Buy to Let Property Investment Fundamentals

- Buoyancy underpinned by demand

- Where owning property is impossible for first-time buyers

- Population growth effect on house prices

- Where UK property is affordable

- Will there be a house price crash in the UK?

- The future of the property market

The buoyancy of the property market is underpinned by demand

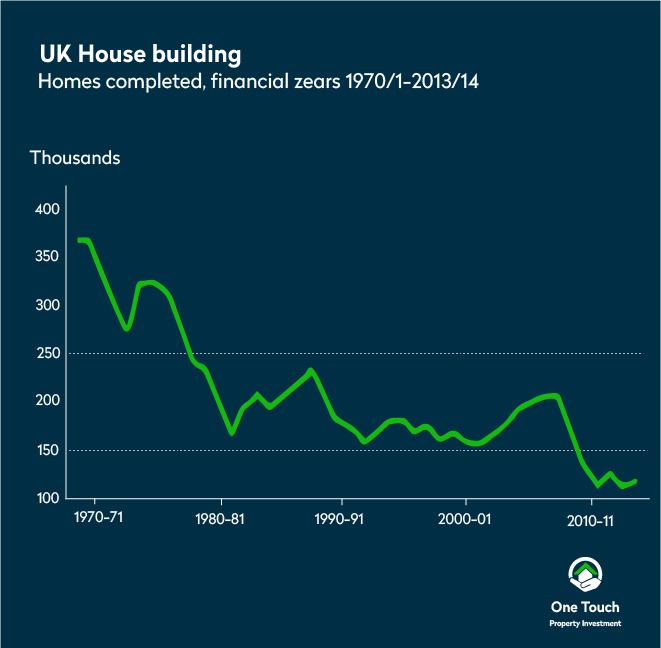

House prices in the UK are buoyed by soaring demand. For years now, housebuilding has failed to keep up with the need for houses, and as houses become a more sought after commodity, it is understandable that prices have risen. This is the same whether you are looking to buy a house or apartment as an investment in the UK.

In the 30 years between 1989 – 2018, 3,328,850 houses were built in England. Compared to the previous 30-year period 1959 – 1988 where 7,449,160 were built. This demonstrates a shortfall of 3,120,310 homes or 104,000 a year for the last thirty years. It is not just the number of houses being built, but also the house type and location. Data suggests that most houses built in the past thirty or so years have been in places were local economies are sluggish, or in previous green belt land miles away from the city centre.

Start your property journey...

Owning property in some parts of the country is almost impossible for first time buyers

In some parts of the country, property prices are so unaffordable that even government-backed initiatives do little to help first time buyers. In London, the average property price is £671,989. The government’s Help to Buy scheme allows buyers to put down a lower deposit and pay less for the first five years. The issue is it can only help if the property is £600,000 or less in value, so already below the London average. Also even if the scheme was used on a £600,000 property, individuals would have to raise a £30,000 deposit and obtain a mortgage on 55% of the value of the property or £330,000 (a government loan of up to 40% is available on London property). As mortgage lenders typically lend 4x the applicant’s annual salary, they would need to be earning £82,500 per annum to be successful. This is way above the average salary. As you can appreciate, getting on the property ladder in London is very difficult unless you are a very high earner or have significant savings.

When considering buy-to-let property investments in the UK it important to focus on areas where property prices are lower. You will find that you can achieve better rental yields and there is more capacity for capital growth. See our best places to invest in property post to find out the areas we think are worth considering.

Population Growth Will Push Up House Prices Even Further

Back in 2015, Moody’s observed that population growth will push up house prices. The Office for National Statistics has predicted that by 2027, the UK’s population will increase from 64.6 million in 2015 to 70 million. Several factors have contributed to that increase; more people are moving to the UK than emigrating to other countries, and people are living longer so births are currently outnumbering deaths.

Not only will population growth push up house prices, but also the change in the family dynamic. In years past, it was normal for a household to have two parents and two children, whereas nowadays a household can be made up of single persons. In fact, in 2018 15% of all households accounted for in the UK were one-person households. This further depletes the availability of stock.

Moody’s stated that Britain has the ideal environment for property investment due to its rising population. In to March 2020, accoridng to the Office of National statistics, net inward migration increased to 313,000. Thereby increasing the demand for houses while building works stopped due to Covid-19 and is set to slow down as there is a shortage and increased cost of labour meaning that there will be less homes being built. This makes investing in rental properties a good idea and the perfect time to start building a buy-to-let portfolio.

There Are Still Affordable Pockets of the UK

London is not just unaffordable for first time buyers. There is opportunity if you look beyond London, as we have found many investors are now doing. London’s property market is a precarious one, as although rents are high, they never really compare to the high property prices and therefore yields are generally low. Those banking on capital growth will be hoping that the London bubble does not finally burst, as many are predicting it will.

Other towns and cities, especially up north, provide good value for money when it comes to housing. As we mentioned above, it felt at times that people often sacrificed either having an affordable home or living somewhere with a good local economy. Fortunately, with government plans to regenerate and stimulate economies outside of London, business in other parts of the UK are growing without compromising house prices (for now at least).

Two major cities that have undergone significant regeneration include Birmingham and Manchester. They often vie for the title of the UK’s second city, but they’re both top when it comes to property investment. You can find out more about regeneration in Manchester throughout the years and similarly how Birmingham has been rejuvenated with parts even being dubbed a second Shoreditch. We also explain how those projects have made the cities better places to live. In 2019 Manchester was named by The Economist as the “Most Liveable City in the UK”. Being attractive places to live will correlate with property prices. Property prices in Manchester are forecasted to see the highest spike of any UK city over the next five years, and since 2016 property prices in Birmingham have risen by 16% - the highest of any UK city.

If you’re looking at areas closer to London, we recommend considering London commuter towns. More and more people are moving out of London to commuter towns for improved life satisfaction and property that is affordable. Luton for example, takes around 25 minutes on the train to get to King’s Cross, yet the average property price is £265,269 – less than half that of London.

Regeneration and the movement of people from one city to another is a major driver in house price growth. Prices do not rise unilaterally across the country, there are always cities that experience accelerated growth and those where increases are sluggish. The strategy here is to pick the right city and the right time because every area hits a peak eventually.

Download our free buy-to-let guide to learn more!

Read our list of UK property hotspots where we think it is worth considering due to high capital growth potential, good rental yields or regeneration plans in the area.

Will there be a house price crash in the UK?

Unpredictable events such as the Coronavirus pandemic have rocked the UK's economy and impacted the housing market. Various lockdowns meant that estate agents were unable to conduct house viewings and the property market stagnated for several months. The pandemic coupled with Brexit have had the biggest impact on the economy and housing market in recent years. There were several reports of an expected house price crash due to these unforeseen events compunded by Brexit, and a perceived "housing bubble".

The government has responded to the pandemic by putting into place short term measures to stimulate the economy and housing market, such as the stamp duty holiday. This has boosted sentiment as buyers flock to the market to make savings before the deadline.

Regarding the "house price bubble" or "property bubble", as long as there is a demand for housing, prices will remain stable or increase. Although prime central London property may be out of reach of many, there are still areas where there is scope for growth. Read our property sourcing principles to learn about how we approach finding new developments.

Although property values may slow or dip in the short term due to unforeseen events, long term fundamentals remain the same and a widespread house price crash in the UK is not on the horizon.

Demand still outstrips supply and the UK's property market has proved to be resilient to many external factors. Average UK house prices rose by £13,316 in 2020 despite the UK officially leaving the European Union and being hit by the Coronavirus pandemic.

The future of the property market

Government policy continues to shape the future of the property market, whether for better or worse. The Help to Buy Scheme, which helped get many first-time buyers onto the property market, is gradually being phased out and is due to end in 2023. This will of course, come as a massive blow to young professionals looking at buying their first property. We think this could mean that many more young adults could be renting for longer, and high tenant numbers can affect rental yields that can be achieved.

Although a larger number of potential tenants can positively affect rental yields, landlords may have a tricky time maximizing profits with the new measures the government has introduced. Landlords can no longer deduct mortgage interest payments from their rental income before paying tax. Instead, their entire rental income will be subject to tax. Also, landlords are required to obtain a licence to rent out an HMO property, and at £500 it will eat into profits.

Download our free buy-to-let guide to learn more!

Regardless, many American funds are investing in the private rental sector (PRS) and it continues to be a multi-million-pound industry. Capital from north America accounts for almost half (GBP15.8 billion) of the total amount targeting the UK’s PRS sector. If large funds are still seeing opportunities in the UK property market, there is hope for the individual as well. If you are looking at investing in the UK property market on a larger scale, you can participate in a joint venture on UK property development opportunities.

Alternatively, we source buy to let opportunities in areas where we predict there to be high capital growth and good rental yield prospects. To bypass some of the government measures recently introduced, you should buy property in a limited company name. Investing in buy-to-let property in the UK through a company would mean you would still be able to claim the interest expense of your mortgage payments. To find out more about financing your investment, read our buy to let mortgage guide.

The long-term fundamentals of the UK residential property market are strong. If you would like to discuss the current market trends and discuss our buy to let properties for sale with an informed property consultant, please do arrange a strategy meeting and we will be glad to to assist you.

Start your property journey...

Recommended Properties

Related Articles

Are you curious?

Speak with an experienced consultant who will help identify suitable properties that will capture the exciting fundamental mentioned here.

WANT TO LEARN MORE ABOUT PROPERTY INVESTMENT?

SIGN UP TO OUR NEWSLETTER NOW!