Social Factors that Affect House Prices

Social Factors that Affect House Prices

Which social forces are causing house prices to rise?

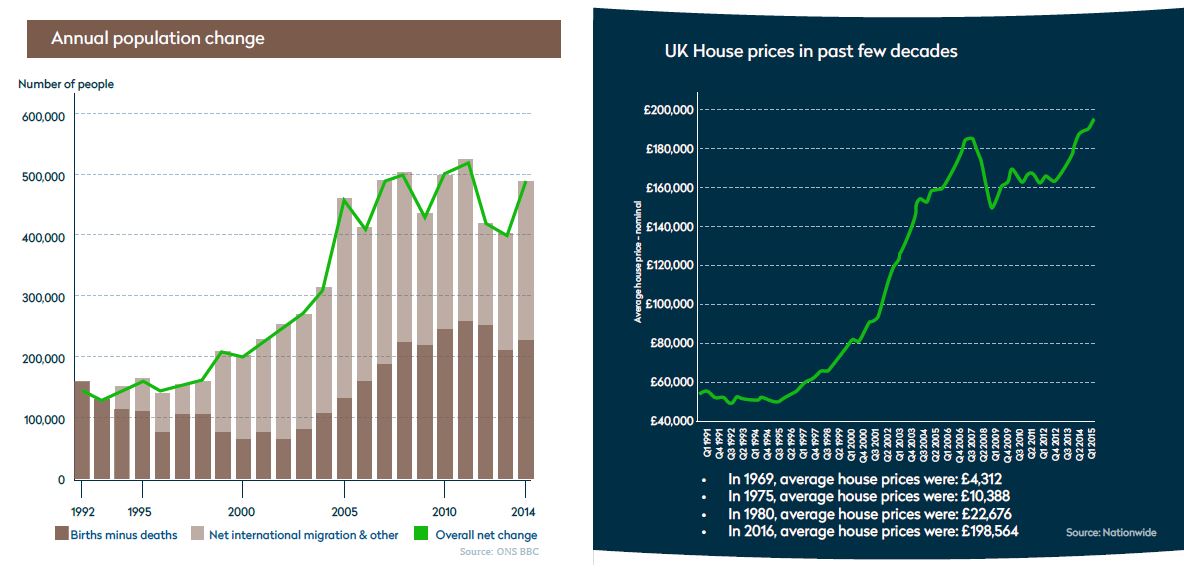

Recently, we highlighted government measures that have contributed to housing shortages and subsequent house price rises. The increase in house prices over the years is nuanced, and property prices have not risen in all areas equally. Government measures such as selling off council homes under “Right to Buy” and limiting councils’ ability to build and source funds has limited the availability of affordable housing. Similarly, deregulating the financial industry made mortgages more widely available, which, combined with a lack of house building, reduced the supply of homes, and made home ownership a more valuable commodity.

As previously mentioned, not all areas have experienced house price increases equally, and there are several reasons for that which we will cover. Also, demand is not only instigated by a rising population. The shift in household makeup and increase in the number of single-person households has also put pressure on supply.

What factors make an area desirable for residents?

The more desirable an area, the more expensive properties are within it. Residents are looking for a number of things when deciding on where to live. These factors, along with a shift in household make-up and a rise in the ownership of second homes, drive property prices.

- Where the house is located – a shift from suburbia to city centre living

- Proximity to good quality schools

- Proximity to everyday amenities

- Shift in household make-up

- Owning an additional property / second home

- High employment = high property prices?

Where the house is located – a shift from suburbia to city centre living

Going back a generation and the tranquility of suburban living was favoured over the hustle and bustle of the city-centre. Central areas of most large cities were often associated with poverty and deprivation and accommodation located within was cramped and unclean. Nowadays due to the regeneration of many city centres, it is preferred. Walking around the centre of any large UK city such as Birmingham, Liverpool and Manchester demonstrate this. Warehouses have been repurposed into living spaces and co-working offices and dilapidated buildings have been transformed into independent coffee shops and eateries. People are spending more of their leisure time in the city-centre rather than rushing off home after work.

Census results from 2015 show that the city-centre population in Manchester grew by an astonishing 149% since 2002 and was mostly concentrated in the wards of Deansgate and Piccadilly. The city-centre populations in Leeds, Birmingham and Liverpool grew more dramatically at 150%, 163% and 181% respectively.

The regeneration and sudden desire to live more centrally has meant property in city centres are generally more expensive than their suburban counterparts. According to research data from Centre for Cities, in Manchester one square metre of city-centre floor space is worth £3,100, compared to £1,800 for the city as a whole. Similarly in Leeds, city-centre floor space costs £2,300 per square metre, whereas it costs £2,000 in the wider city area. Affluent suburbs do still exist such as Solihull in Birmingham, but overall, city-centre residential property prices are around 10% higher than suburban property prices.

Proximity to good quality schools

In the UK, children attend state-funded schools that are in their catchment area. This means that they would have to live within a certain distance of a school to be able to attend it unless they have a sibling already at that school. The result of this is that some parents move neighbourhoods to be within the catchment area of a good school. As competition for places is fierce, property that is within acceptable distance of a well-performing school often comes at a premium. Research from PwC has found that in England property prices close to top primary schools carries an average £27,000 premium, and homes close to top secondary schools comes at a £25,000 premium.

Regions vary in premiums put on property prices in catchment areas for top schools. The largest percentage house price premium for primary schools is 12% in Yorkshire and the Humber. Conversely, there is no house price premium associated with secondary school catchment areas in the East of England. Areas affected with high premiums also tend to be less affordable in relation to wages.

Proximity to everyday amenities

Proximity to other amenities such as outdoor spaces, supermarkets, transport links and medical centres can also have a profound effect on property prices. City dwellers show a preference for being close to plenty of green spaces and are willing to pay a premium for it, meanwhile properties close to new transport links have also experienced an uplift in price.

Start your property journey...

According to the Greater London Authority report, each hectare of park space within 1km of a house increases its price by 0.08%. Being close to sports centres can often positively influence property prices too. According to a study from the London School of Economics, properties surrounding Arsenal’s Emirates Stadium and Wembley have risen by an average of 15% since the stadiums have opened – higher than property inflation in other areas of London. Properties began to rise upon the announcement of the plans, partly because sports centres often fund regeneration projects for the local community, including improved transport links and more green spaces.

Similarly, proximity to transport links can also affect house prices. Although living near an airport can negatively affect a property’s value, research from Nationwide shows that properties within 500m of a tube station carry a 10.5% premium compared to properties that are a kilometre or more away. It is not just tube stations.

Since Crossrail was announced property prices in areas close to proposed stations have risen by 31% across the wider market, and a 10% deduction in travel times can cause house prices to increase by 6%. According to CBRE, residential property in areas close to a Crossrail station can expect to experience an average uplift of £133,000.

Shift in household make-up

A growing population and increase in the number of households influences property demand and subsequently property prices. According to research conducted by the government, a 1% increase in households causes a 2% increase in house prices. The impact this had on the period between 1991- 2016 was a 32% increase in house prices equal to £17,000.

An increase in households is not only down to people living longer and immigration; a higher divorce rate and lower marriage rate has meant that single person households are now commonplace. The number of single-person households in the UK has risen dramatically in recent years and this is putting more pressure on available housing stock. The number of people living alone in the UK has increased by 4% over the last 10 years, from an estimated 7.6 million in 2010 to 7.9 million in 2020.

Owning an additional property / second home

According to research from the Resolution Foundation, around 5.5 million people (11.2%) in the UK own a second home. This was up from 3.6 million in 2001. The main proportion of those who own second homes are high earners from the baby boomer generation (born in the 1950s / 60s). Owning a second property for buy-to-let accounts for the largest group of additional property owners (1.9 million), followed by those who own a second home (1.4 million).

There are multiple ways that owning a second property can affect house prices. One way in which it affects house prices is because it has amplified the problem of under-occupancy of existing housing stock. This problem is particularly acute in the South West of England and the Lake District where second homes are bought as holiday homes, meaning there are fewer houses for residents. As national wealth (and additional property wealth) grows faster than national income, the gap widens between those who own property and those who do not. That does not necessarily directly affect property prices, but it makes property ownership unaffordable for certain demographics in society.

High employment = high property prices?

There is also a correlation between the availability of employment and property prices. This is because people move to chase new job opportunities, and this puts pressure on the housing market in the surrounding area. According to research conducted by Lloyd’s Bank, average house prices in the twenty local authorities with the highest unemployment rate have risen by just £4,100 since 2009, whereas areas with low unemployment have seen house prices rise by an average of £65,000.

Download our free buy-to-let guide to learn more!

In conclusion, it is not just government measures such as a lack of house building that has caused house prices to skyrocket in recent years. Not all homes have experienced such a dramatic uplift in price though, and several factors influence the desirability and consequently value of a home. Homes close to good quality amenities, good schools and employment opportunities will typically fetch a higher price. Residential property in city centres is now seen as more desirable, partly due to urban regeneration and partly due to the proximity of workplaces, amenities, and entertainment venues. The factors we have mentioned have a significant influence on price, and if you are considering property investment UK it is advisable that you keep location in mind. Also, the change in household makeup, due to higher divorce rates and fewer marriages has meant there are more single person households. This, combined with the increase in second home ownership, has put increased pressure on the housing market.

Start your property journey...

At One Touch Property we source UK property investments by taking into consideration the factors we have mentioned in this article. For those looking at property as an investment, we’d recommend reading our best places to buy property in 2021 guide to discover which areas we think look most promising. Taking your first steps in property investment can be overwhelming. Potential investors should have a read of our UK investment property tips to learn more about.

Recommended Properties

Related Articles

Are you curious?

Speak with an experienced consultant who will help identify suitable properties that will capture the exciting fundamental mentioned here.

WANT TO LEARN MORE ABOUT PROPERTY INVESTMENT?

SIGN UP TO OUR NEWSLETTER NOW!