Investment checklist for student apartments and pods

When deciding whether a student property investment will be fruitful, there are many factors you will need to consider. Before going ahead with an investment, you should make sure you have...

Our UK student property investments are located in areas where there is a large student population, allowing for high demand and occupancy levels, translating into an investment that will produce a high yield. Student property is also classed as commercial property and if the purchase price is below £150,000 it is exempt from stamp duty taxes.

The benefit of buying student accommodation investments in the UK is that you have a huge target market as over 2 million students are currently studying in the UK. Areas with a high number of international students in particular experience excellent PBSA occupancy levels. There is often a management company in place so you wont have the hassle of dealing with the day-to-day maintenance of the unit. Many operators offer contracted returns of up to 9% and investing in new developments with premium facilities will allow for good levels of occupancy for years to come. Alternatively we have already completed student property for those who want to receive rental income immediately.

Read on to discover our latest opportunities and where are the best places to invest in student property, and how to invest in student accommodation.

One Touch property consultants will share investment opportunities and guides with you to help you make an investment decision with confidence and ease.

If you choose to invest in student property in the UK, you will need to research cities with a large number of students and accommodation in convenient locations.

We have weighed up the fundamentals of several student towns and cities to suggest some of the best places to invest in student property. These towns and cities stand out due to a variety of factors, from having a high number of students to planning restrictions on student property to suppress competition.

There are many events that have occurred in recent years that could have affected the student property market, from Covid to Brexit. However, if you choose the area for your investment wisely, you can still achieve good rental yields.

When it was announced that the UK was leaving the European Union, doubt was cast over whether the United Kingdom would still be an attractive place to study. There were concerns over whether EU students would have to pay higher fees, and what their status would be after they had finished their studies, and arguably this has deterred some from choosing to attend a university in the UK.

That being said, the United Kingdom is still home to some of the best universities in the world, and the dip in the value of the pound has made it more attractive for those from outside the EU to study. Considering the profitability depends upon such a delicate balance of numbers, is it still worth considering student property investment opportunities? If so, where are the best places to invest in student property?

Start your property journey...

The outlook for UK student property market remains positive and there still appears to be strong demand from institutional buyers for UK student property. Cushman and Wakefield report that student property will remain a robust and profitable asset, due to strong demand. The UK maintains a healthy amount of student applications, with overseas applications up from 2019 figures. In partnership with Rasameel Investment Company, Cushman and Wakefield have just acquired two developments in Edinburgh and Leicester for a combined £22.2m. This indicates their continued confidence in the market.

Investors do not have to invest in shares or a student fund. Other options include studios in purpose build student property developments. On average, the studios typically cost £80,000, with the more affordable student en-suite rooms (pods) priced just below £60,000. The typical net income ranges between seven to eight percent (7%-8%) after full management and other associated costs have been deducted. The benefit of investing in studios and pods is that an experienced management company will generally handle the day-to-day maintenance, and issues such as finding new tenants and marketing the studios. This lifts an enormous weight off the investor’s shoulders, and means it is perfect for the individual who cannot dedicate a lot of time to the investment, or for those who are living overseas and cannot be physically present to undertake daily maintenance tasks.

Those concerned about the sustainability of the UK student property investment sector can draw upon the analysis provided by global real estate consultancies such as the Savills in depth report on the student market.

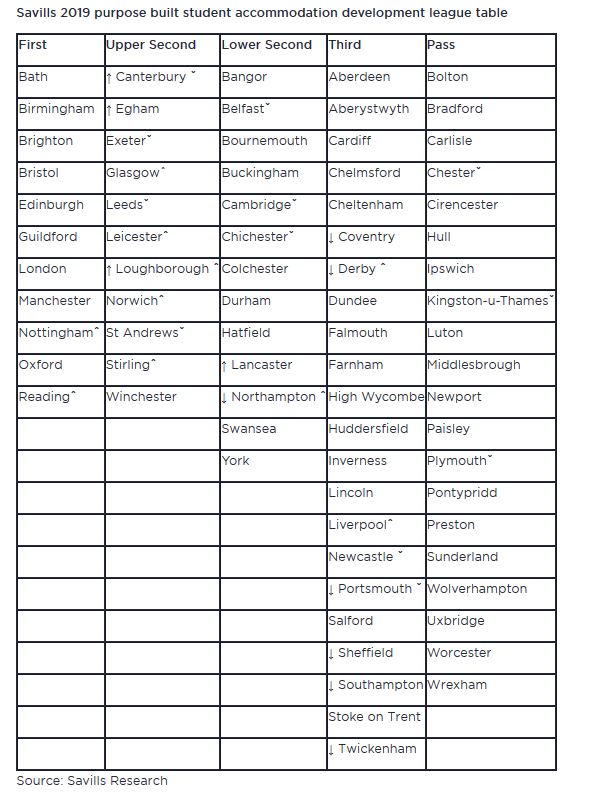

The report measures a number of factors including current availability of purpose-built student properties as well as the pipeline of future developments balanced against the student demand and university rankings.

Start your property journey...

Not only is Birmingham a good choice for buy to let investments, it is also promising for those looking to invest in student property. The city itself is hoem to five universities, so there is a large number of students. Property itself is also cheaper compared to other cities, even purpose-built student accommodation. In the Savills Student Property Development League Table, it was ranked in the first tier. Cities are ranked due to predicted occupancy rate and rental yield achieved after supply and demand fundamentals are measured.

Nottingham was also ranked in the top tier in the Savills Student Property Development League Table.

Home to over 70,000 students, Nottingham has one of the largest student populations of any city in the United Kingdom. It is ideally located in the middle of England, and its strong transport links makes it easily accessible from most other parts of the United Kingdom.

It boasts a £12bn economy, making it the economic capital of the East Midlands and £1bn has just been invested in transport links and infrastructure.

Download our free student guide to learn more!

Article 4 direction has been adopted in Nottingham for the past six years. Article 4 direction prevents family homes being converted to houses of multiple occupation. Thereby restricting the supply of student housing. Where demand has continued to grow, prices have continued on an upward trajectory much to the delight of Nottingham landlords.

The only way to accommodate more students in Nottingham is through the development of purpose-built student accommodation units. As the council has restricted the supply of alternatives, good occupancy levels can be achieved.

What makes Leeds and attractive city for student property investment?

Leeds is ranked in the upper second tier for student property demand. The vibrant city attracts a cosmopolitan crowd and the renowned University of Leeds attracts students from across the UK and overseas.

Leeds has the ideal environment for a good student property investment. Historically, development levels have been low, so there is not much competition and high demand. Due to the fact that students generally come from far afield to study in Leeds, many need accommodation as opposed to commuting in from home. Thirdly, they are more likely to choose purpose-built student accommodation over university owned halls of residence.

Leeds has one of the most diverse economy of the all the UK’s main employment centres. In 2016, Leeds saw the fastest rate of private sector jobs growth of any UK city and has the highest ratio of public to private sector jobs of all the UK’s Core Cities.

Marks and Spencer’s was founded in Leeds. Back in 1884, Michael Marks opened up his penny bazaar stall in Leeds Market before enlisting the help of Tom Spencer a decade later. Soon after, they moved to a permanent spot just around the corner and the rest, as they say, is history.

Contact us today to find out more information regarding the best places to invest in student property.

To learn more about this asset class, download our free student guide.

Start your property journey...

Student property in the UK has been popular with investors for years, due to he UK's vast number of well-ranking universities and large student population. If the right city and accommodation is chosen, occupancy levels and rental yields can be high.

Interested in student property but wondering how to invest? Click the green arrow to find out more...

If you are considering buying student accommodation, whether a flat, house or pod in a PBSA development, you will need to consider various fundamentals before moving ahead.

Firstly, you will need to analyse the town or city you are considering investing in. Does it have a large student population? Are the students from the area or from overseas? Are there many existing developments in the area? What are their facilities and rental costs like?

Also decide how much time you are willing to dedicate to the investment. If you buy an HMO you will have to undertake all the day-to-day management yourself, and this can be time consuming. On the plus side, you will not have to pay management fees to someone to run it for you.

Conversely, investing in purpose-built student accommodation can be ideal if you cannot spare a lot of time to manage the property. A management company is put in place who will run the property on a day-to-day basis. Although this will free up your time, you will have to pay a fee and this will affect the net yield achieved.

Download our free student guide to learn more!

You also need to make sure you have the funds available. Student property is classed as a commercial investment and these are generally cash-only. You will find it difficult to get a mortgage on purpose-built student accommodation such as a pod or cluster flat. You may find it easier to get a mortgage on an HMO (house of multiple occupation).

Once you have decided on the location and you have sorted out your budget, you can speak to an agent such as us here at One Touch Property. One of our investment consultants can help you on your investment journey by discussing the latest student accommodation investments we have on our books that fit within your budget and location preferences.

Start your property journey...

Here at One Touch Property, we have analysed the fundamentals in the UK's student towns and cities, and we can present to you many student property investments that are currently for sale in the best student towns and cities. Read our fundamentals of the student property market to discern which cities you should be considering.

When deciding whether a student property investment will be fruitful, there are many factors you will need to consider. Before going ahead with an investment, you should make sure you have...

When deciding to invest in student property, there are lots of things to consider. What are some of the core fundamentals you should take into account before investing? Do you know the long term...

Student property investments often outperform other commercial property types in the UK. However, some opportunities can be more lucrative than others. If you choose a city with weaker...

Where are the best place in Liverpool to invest in student accommodation? What makes each area attractive to students and investors alike? If you are curious, all will be revealed in our Liverpool...

Landlords are finding it increasingly difficult to make a profit through buy to let property due to additional taxes levied and the scrapping of mortgage interest tax relief. The government has made...

UK property is seen as a valuable asset worldwide. How can investors from overseas own UK property? Learn more about the property purchase process, UK property terminology and UK taxation on...

WANT TO LEARN MORE ABOUT PROPERTY INVESTMENT?

SIGN UP TO OUR NEWSLETTER NOW!